ny highway use tax rates

24 rows Claim for Highway Use Tax HUT Refund. The tax puts New York at a competitive disadvantage and is a primary reason why New York ranks as the 5th most expensive state in the nation in which to operate a truck and the 2nd most expensive state in the Northeast.

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

This applies to sales of qualified.

. The highway use tax HUT is imposed on motor carriers operating motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. The New York highway use tax HUT sticker is required to be paid by all motor carriers both interstate and intrastate operating certain motor vehicles on public highways in the state of New York. For information regarding highway use tax see Tax Bulletin An Introduction to Highway Use Tax TB-HU-40.

4 rows you operate a motor vehicle as defined in Tax Law Article 21 in New York State. For assistance calculating highway use tax see Tax Bulletin How to Determine Your. New York State Highway Use Tax TMT is imposed on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway.

90300201220094 Page 2 of 2 MT-903 122 To compute the tax due on the schedules below see the Tax rate tables for highway use tax on Form MT-903-I Instructions for Form MT-903Be sure to use the proper tables for your reporting method. To Highway Use Tax and Other New York State Taxes for Carriers. New York is the only state in the northeast and only one of four states in the nation with a highway use tax HUT.

Form MT-903 is filed monthly annually or quarterly based on the amount of the previous full calendar year s total highway use tax liability Monthly - more than 4 000 Annually - 250 or less with Tax Department approval Quarterly - all others including carriers not subject to tax in the preceding calendar year You may request a change of filing status based on your. The tax is based on miles traveled on New York public highways excluding toll-paid portions of the New York State Thruway. You are also able to purchase a one-time temporary KYU Permit per truck in the event you are not making regular trips through the state of Kentucky.

What is the highway use tax and how is it calculated. The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the. Use highway use tax web file to report and pay highway use tax.

Including local taxes the New York use tax can be as high as 4875. The New York use tax rate is 4 the same as the regular New York sales tax. Ny highway use tax return instructions.

Highway use tax schedule totals first complete schedule 1 or schedule 2 or both on back page and then enter final totals in boxes 1a and 1b below schedule 1 total tax schedule 2 total tax total highway use. Use Form 2290 to. Local Sales and Use Tax Rates on Qualified Motor Fuel Highway Diesel Motor Fuel and B20 Biodiesel Effective March 1 2022 Publication 718F 322 In 2006 the New York State percentage rate sales and use taxes sales tax on motor fuel and highway diesel motor fuel changed to a cents-per-gallon method.

It is a tax license issued for all carriers traveling on Kentucky roadways with a combined license weight greater than 59999 pounds. The tax rate per mile for vehicles weighing 78001 to 80000 pounds is 00546 per mile. New York Highway Use Tax.

The weight of the motor vehicle and the method that you choose to report your taxes determines the tax rate that you must pay. Form MT-903 is. The tax rate is 00285 cents per mile.

These carriers are required to register and obtain a New York HUT certificate and decal. To register fill out Form TMT-1 or use their online registration system. The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you.

New York imposes a Highway Use Tax HUT on any motor carrier using New York highways with a gross vehicle weight over 18000 pounds. New York State imposes a highway use tax HUT for motor carriers operating specific motor vehicles on NYS public highways excluding toll-paid sections of the New York State Thruway. If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both on the back of the form to calculate the amount of tax due.

The New York use tax should be paid for items bought tax-free over the internet bought while traveling or transported into New York from a state with a lower sales tax rate. Other states tax forms 2022 highway usefuel use tax IFTA Select to view another year - Year - 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985. Publication 538 708 1 This publication is a guide to the New York State highway use tax and includes information regarding vehicles subject to tax registration requirements exemptions record keeping returns and special provisions.

How Do State And Local Sales Taxes Work Tax Policy Center

Ny Hut Permits Ny Hut Sticker J J Keller Permit Service

Everything You Need To Know About Vehicle Mileage Tax Metromile

Roads To Nowhere How Infrastructure Built On American Inequality Cities The Guardian

Highway Use Tax Web File Demonstration Youtube

A Speed Limit On Germany S Autobahns Like Talking Gun Control In The U S Npr

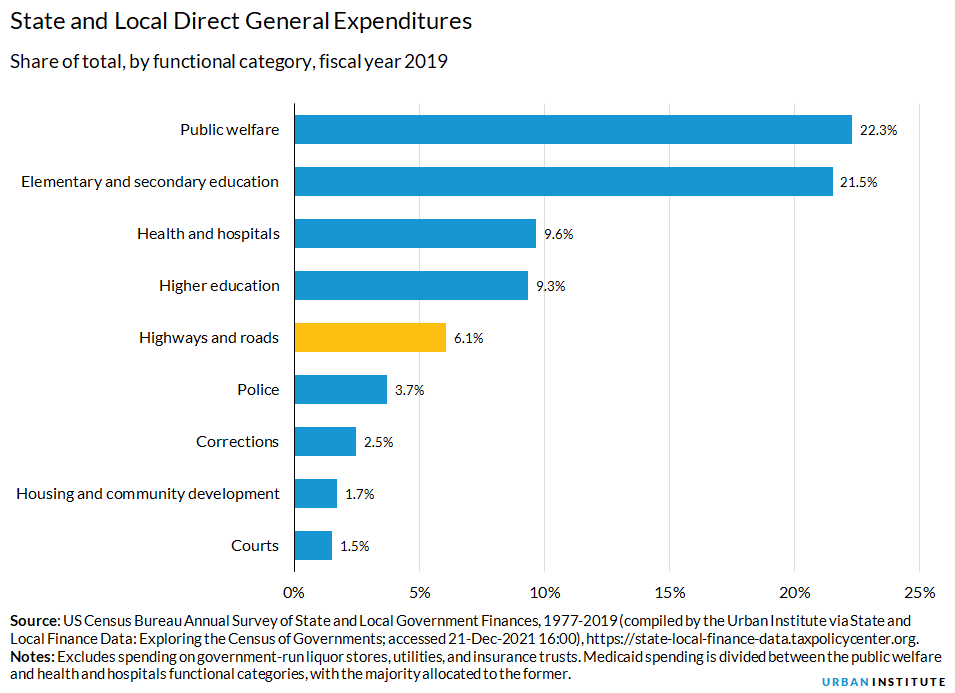

Highway And Road Expenditures Urban Institute

Highway Use Tax Web File Demonstration Youtube

Ny Hut Permits Ny Hut Sticker J J Keller Permit Service

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

North Carolina Nc Car Sales Tax Everything You Need To Know

How Do State And Local Sales Taxes Work Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_image/image/69847422/1233506003.0.jpg)

How To End The American Dependence On Driving Vox

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center